Buying your first home is one of life’s most exciting and fulfilling journeys. To be sure, it's not always an easy path to become a first-time homebuyer, but the rewards far outweigh any risks or roadblocks you may face along the way.

Being a first-time homebuyer comes with several incentives, too, that can put you in a home faster and in a more favorable financial position. It's a great starting point as you take the initial steps into one of the most common forms of wealth-building in the U.S.

Below, we offer first-time homebuyers a guide to help you navigate the process.

Advantages of being a first time home buyer

An overlooked aspect of being a first-time buyer is the incentives attached to securing your first home. Even in uncertain times, homeownership remains a critical component of financial and personal security. There are plenty of programs to help you achieve your home-buying goals.

Even as a first-time buyer, you're eligible for several standard home loans, including the popular 30-year or 15-year fixed-rate mortgage. Others include:

- Conventional loan: a non-government backed loan that can and should be shopped around to find lenders with the best terms

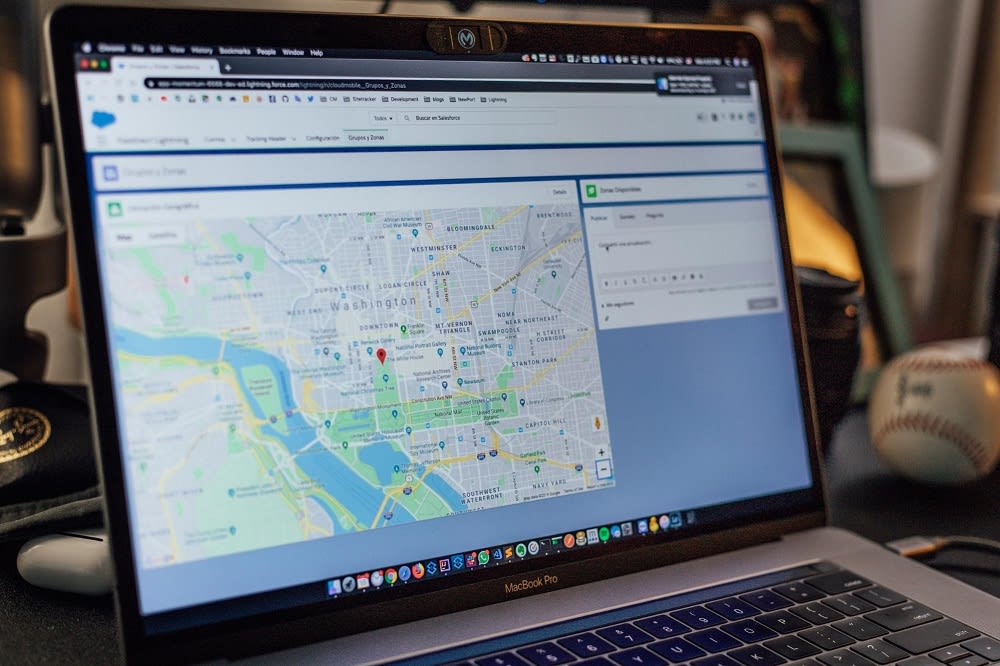

- Jumbo loan: designed for homes priced above a certain threshold, which varies from year to year (currently $548,250 for single-family, and $822,375 for high-cost areas such as Washington, D.C.); requires high credit score and at least 10% down payment

- FHA loan: insured by the Federal Housing Authority, allows as little as 3.5% for a down payment and credit scores as low as 500

- VA loan: insured by the U.S. Department of Veterans Affairs and available to all members of the armed forces and veterans (and their spouses); no down payment required

Because of your status as a first-time buyer, numerous loan programs are available to assist you in purchasing your home. Many assist with the down payment and/or closing costs.

Additional incentives are often set by states, counties, or cities, which in the Capitol region means access to programs from Washington, D.C., Maryland, or Virginia.

Ready your finances

A common mistake for first-time homebuyers is underestimating the actual cost of purchasing a home. This includes homes that appear modestly priced relative to their market.

Especially in competitive markets, available homes often sell for above the asking price. Unless you're bringing an all-cash offer to the proceedings, lining up your finances to secure a loan is an essential first step to buying a home.

You’ll need to verify your credit. Excellent credit scores secure the best lender rates. The better the terms, the less you'll pay throughout the loan. If your credit is a little suspect, it may be a better strategy to wait until your credit improves to secure a loan. Waiting for a better credit score could save you thousands over the life of the loan!

Your savings play a role, too, as you'll need to ready the funds for a down payment. As we've seen, specific loan programs provide for an extremely low down payment.

However, unless you're willing to hand over the industry-standard 20% down payment, expect to pay private mortgage insurance (PMI) for the early stages of your loan.

A little extra cash proves helpful after you secure the loan. From modest fixer-uppers to luxury-laden homes, there are almost always additional expenses when acquiring a new property - especially when it's your first.

Consider that purchasing a home involves the following costs:

- Down payment

- Appraisal fees

- Inspection fees

- Closing costs

- Moving expenses

Then comes the costs of actually owning the home:

- Mortgage payment

- Insurance

- Property taxes

- PMI (if applicable)

- HOA dues (if applicable)

- Utilities: electricity or gas, water, sewer, and trash

- Internet or cable

- Property upkeep, including landscaping, pest control, seasonal HVAC

The grander the home and more sought after the neighborhood, the higher your costs will be. In addition, if a lender approves you for a loan, your home purchase doesn't have to be the full amount. There are few things worse than a first-time home purchase where you overextend yourself on day one.

To help you stay on track throughout your home buying journey, and maintain a realistic outlook, craft a budget for both sides of the acquisition. The better you've prepared your finances, the more confident (and satisfied) you'll be with the outcome.

Identifying a real estate professional

Real estate professionals serve as a valuable resource at every step of your home buying journey. Particularly for first-time buyers, where everything is a new experience, the right agent can simplify an otherwise overwhelming process.

Beyond showing you the homes best suited to your budget and lifestyle, an experienced real estate professional provides insight on:

- The pros and cons of specific neighborhoods

- Home pricing, including if a home is under- or overpriced for its age, location, and amenities

- Communities on the upswing, trending down, or those that prove excellent long-term investments

- Demographic trends, major employment centers, top commercial districts, and an area's best schools

Agents serve as your advocate throughout your home search. They represent your best interests during showings, the offer, negotiation, and inspection stages, all the way through to home closing.

Identify the best agent for your needs by seeking referrals from people you trust. Consider those professionals that specialize in working with, and have a track record of, helping first-time homebuyers.

Shopping for a home

The most fun you'll have during your first home-buying process is the house hunt. But it's also one of the most critical stages in acquiring your first property.

Before starting a home search, identify what you hope to get out of your home - and, more importantly, what you'll need while maintaining your budget goals.

Your first-home wishlist will give your agent a starting point for identifying homes and neighborhoods that suit your lifestyle. It ensures an efficient tour process, so you're not wasting time viewing homes you don't want or cannot afford.

During the home search, maintain an open mind. First-time buyers often have unrealistic expectations about finding everything they want in their first property. Tight markets with limited supply are an eye-opening experience. Preparedness is key.

Before you even start the home search, decide what you can and cannot live without.

Understanding the buying process

When buying your first home, there's a level of anxiety that will accompany you on your journey. Much of it is due to the nervous excitement of acquiring a new place to live, a fresh start for you and your family.

There's also the anxiety that stems from navigating an unfamiliar process. It’s understandable, considering the financial commitment you're about to make! The good news is that home buying is relatively straightforward - even if it can take a considerable amount of time.

To streamline the process, once you settle on a loan and a supportive lender, is to immediately go for preapproval.

Short of offering all-cash for a home, a preapproval is the best thing you can have in a competitive marketplace - it secures your loan and indicates to sellers that you’re serious about buying when you make an offer.

Again, shop for loans and lenders — as thoroughly as your home itself — to ensure that you're getting the best rates and programs available in your area.

The closing stages

Though it can feel like an eternity, once you make an offer on a home, the process will usually move quickly. The two most important factors for your offer are that it's competitive and that you're comfortable with it.

Seller's markets can lead to fierce bidding wars. As difficult as it might be when vying for your first home, remove your emotions from the process, and avoid attempting to "win" a house.

Expect a counteroffer and some negotiations.

Once an offer is accepted, the closing process starts with the home heading into escrow, which is when the house is removed from the market while the transaction is being completed.

Then, it’s your turn to hire a buyer’s inspector. Having a professional walk through the home on your behalf — as opposed to the seller’s inspector — will confirm a home's condition and reveal any potential issues. With those deficiencies on paper, you can then negotiate to have them repaired, the sale price discount, or you may choose to walk away entirely.

After all of that, parties will agree to the final details, the paperwork is signed, the loan funded - and you’ll walk away with the keys to your very first home.

Ready to explore the best of Washington D.C. real estate? Contact Desmond McKenna today to start your first-time home buying journey. From Dupont Circle properties to Capitol Hill homes for sale, allow Des and his years of experience to be your guide to Washington D.C.'s luxury real estate market.